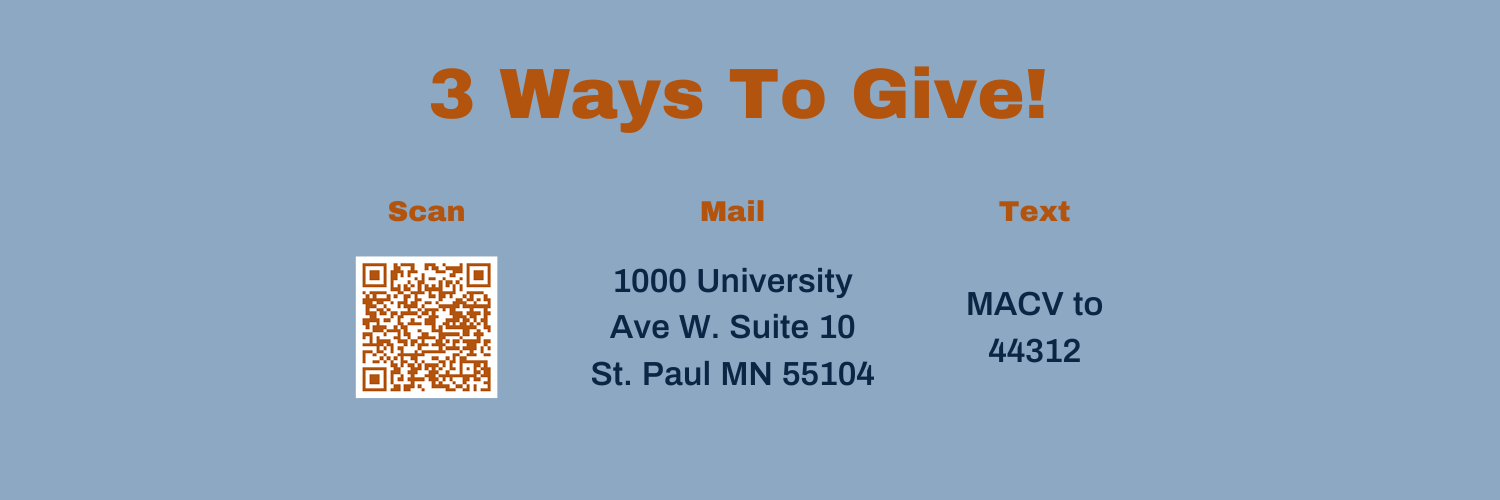

WAYS TO GIVE

Donation Information

MACV has over thirty years of experience connecting with former service members across Minnesota. We use a variety of creative approaches to address the needs of individual Veterans experiencing housing instability or homelessness.

Supporting MACV empowers Veterans living in Minnesota, resulting in advocacy and assistance for Veterans starting a new chapter of their lives.

Our EIN number is 41-1694717 and you can find many ways to support MACV below!

Service Enterprise Logo

Candid Logo

Charity Navigator Logo

DONATE YOUR VEHICLE

This is an easy way to give

Give your used vehicle a new purpose when your donate it to MACV. Donating is easy, the pick up is free, and your gift is tax-deductible.

- Donate your car, truck, motorcycle, RV, or boat to the Minnesota Assistance Council for Veterans by simply completing the form below, and we’ll reach out to you to arrange the pick-up of your vehicle donation, at no cost to you. You may qualify for a tax deduction while supporting a cause that is near and dear to your heart!

- Whether your vehicle sells for $500 or less, more than $500 or $5000, you will be provided with the proper donation tax receipt(s).

Start now by making a call or visiting online:

- 1-855-500-7433

- Schedule Online Now

THREE WAYS TO GIVE WITH INVESTMENTS

Increase your impact, Reduce your taxes

Gifts of appreciated stock, bond, or mutual fund shares

- Can be a tax-advantage to provide support for MACV *

IRA Qualified Charitable Distribution

- Must be 70 ½ or older

- Give up to $100,000

- Avoid federal income tax on the distribution

- Can be used to satisfy your required minimum distribution (but not limited to your RMD)*

Make MACV a Beneficiary of your IRA

- One of the most tax-efficient ways to fund a charitable gift of your estate

- Reduce or eliminate federal estate and income taxes*

- Designate part or all of your IRA to make an impact at MACV

*Call your Tax Advisor to see which best fits your investments. If interested in making a stock donation, please call MACV headquarters at 651-291-8756 for more information.

Click here to access our most recently available annual financial statements and 990 tax filings.

SEE IF YOUR EMPLOYER WILL MATCH YOUR DONATION

JOIN OUR TEAM OF RUNNERS

COMBINED FEDERAL CAMPAIGN (CFC)

Are you a federal employee or retiree? Join the 2021 Combined Federal Campaign (CFC) and donate to MACV today!

Ready to make a difference in a Veteran’s life? Start here! Search for us with:

- CFC code 84275 or

- EIN number 41-1694717

The online pledge portal allows you to easily renew your pledge each year and offers the full range of pledge options:

- Payroll deduction (the most popular!)

- Credit/debit card

- E-check/bank transfer

- Volunteer hours (federal employees only)

- CFC Giving Mobile App and paper pledge forms.

Veterans need your help today. Do your part to end Veteran homelessness and donate to CFC before January 15, 2022. Thank you for your support!

UPCOMING EVENTS

What’s Happening Near You

St Cloud, MN United States

Brooklyn Center, MN United States

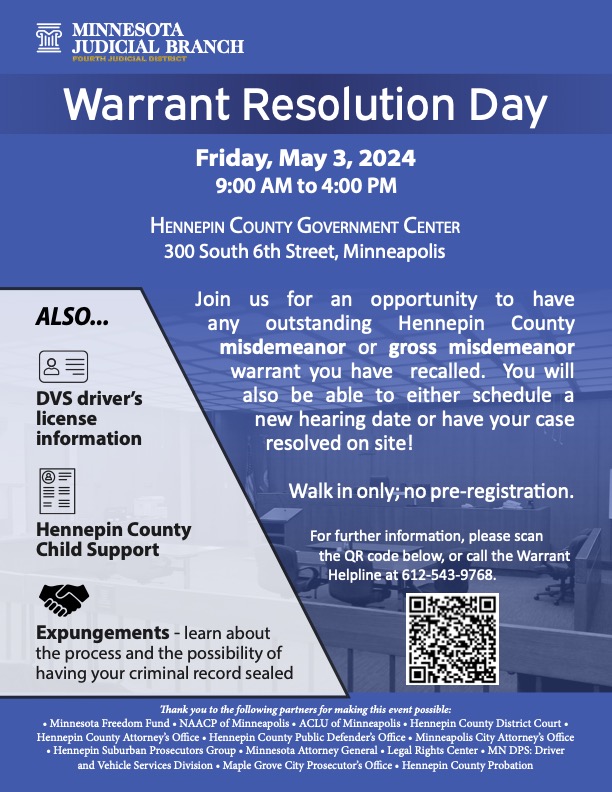

Minneapolis, MN 55487 United States